Protecting private information and preventing loss of data is top of mind for any business owner or manager, and property management is no exception. Save 10% Today Data Protection & Recovery

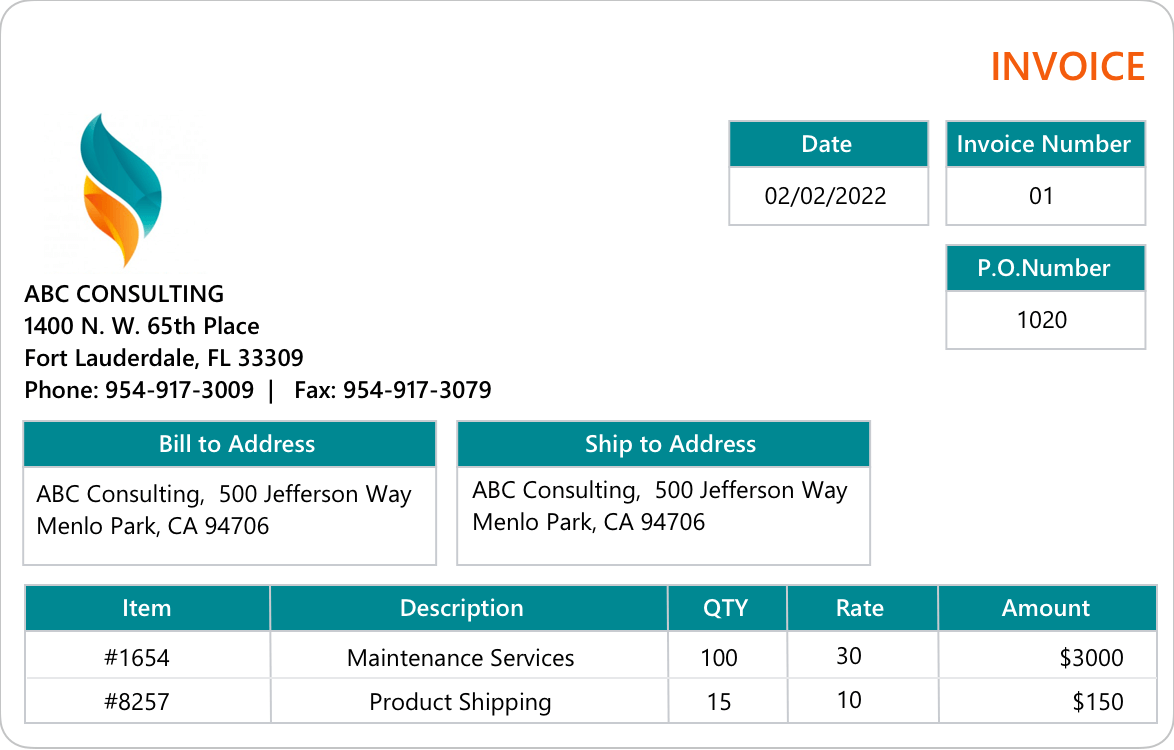

Some even perform tax preparation, allowing users to create Schedule E and Schedule C reports or export the numbers to a dedicated tax package. Some of the more robust packages integrate both rental and personal finances, enabling property managers who are also owners to track their credit cards, bank loans, and retirement and investment accounts, as well as categorize their business income and payments and keep tabs on deductible expenses. Ideally, your property management software should help you automate these processes as much as possible. Look for software that allows you to link your bank accounts, which makes it easier to track rental income and expenses, monitor profit and loss, and calculate commissions or fees owed to managers or leasing agents. According to Michael Park of RentBridge, a consultancy service for property management companies, “Property management accounting is different from standard accounting because you not only need to keep track of your property management company’s finances, you are also managing separate accounts for the properties you manage.” Accounting & Expense TrackingĪccounting is one of the more time-consuming tasks facing property managers-especially those who manage multiple properties. Make sure the software you choose has the capability to maintain vendor lists that include contact information, business information such as tax ID numbers, and all transactions (e.g., work orders, bills, payments, credits, and refunds).

Depending on the size and needs of your property, you may be managing general contractors, landscapers, handymen, plumbers, utilities suppliers, insurance companies, building supply companies, and more. Your vendors are also an essential part of your business.

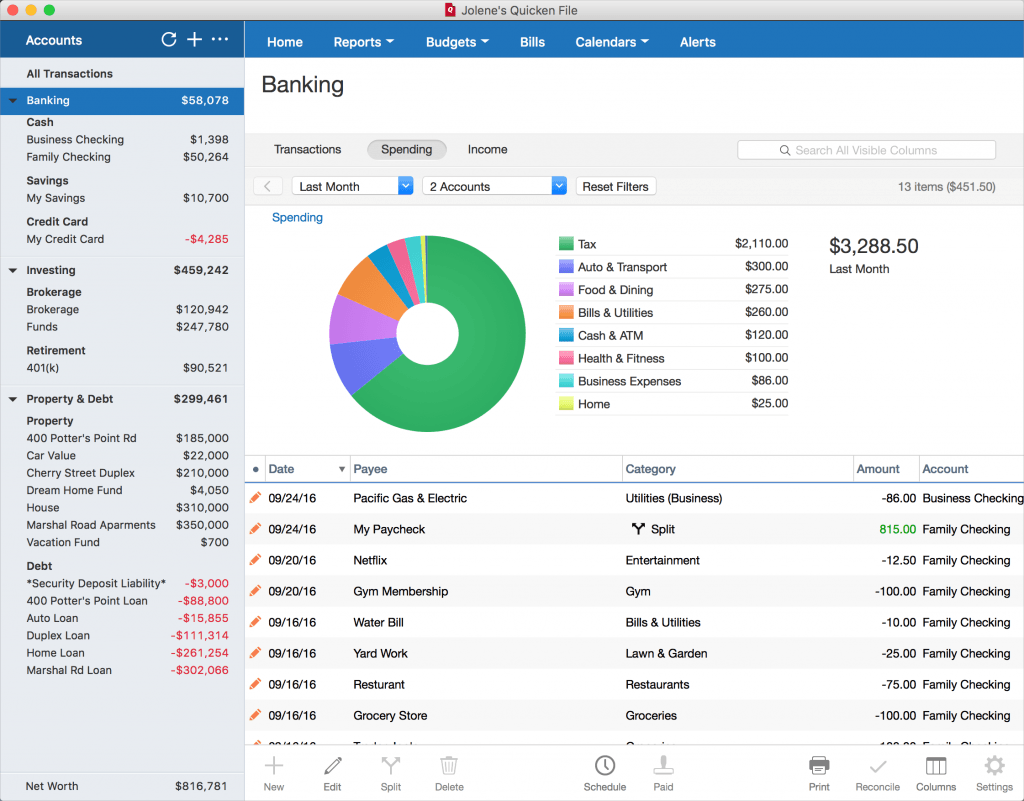

It’s also helpful if your software includes the capability to communicate with your tenants, such as via email, so you can keep them up-to-date on anything from overdue payments to planned maintenance dates. For tenants, you should be able to track contact information, rental agreements, move-in and move-out dates, security deposits, rent payments, rent receipts, and late fees. When reviewing your options, you’ll want to make sure any software programs you’re considering will allow you to manage and maintain data for both your tenants and your vendors. It also has personal finance capabilities, allowing users to merge their personal and business accounting in a single place. Quicken’s Home & Business, for example, can be accessed across desktop, web, or mobile platforms, as well as via the Quicken app. Preferably, your software will feature an intuitive user interface, such as a dashboard that prominently displays important items like your properties, occupancies, and rents received.ĭepending on your personal preference, you can choose a cloud-based solution, i.e., one that is web-based and accessible online, or you can choose a subscription-based software package to use on or more of your preferred devices. Regardless of your property management needs, you’ll want to make sure the software you choose is easy to learn, easy to implement, and accessible on-the-go. We’ve put together a list of features to look for when shopping for landlord software so you can make an educated and informed decision. Whether you manage a single unit or multiple properties, reliable, user-friendly property management software can help you automate and streamline many of your daily tasks. Collecting rent, scheduling and managing repairs, maintaining a budget, posting and updating vacancy listings, keeping track of important legal documents-these are just a few of the many moving parts you have to stay on top of every day. If you’re a property manager, chances are your job requires you to juggle a lot of different tasks at once.

0 kommentar(er)

0 kommentar(er)